P2P lending or social lending is one of the new and interesting opportunities made possible by the online financial platforms organizing the people worldwide. As opposed to the traditional lending and borrowing practice, this scheme is more direct. Traditionally such operations are done through the banks when people lend their money to the banks in the form of deposits, and get paid interest for allowing the bank to use their money for its operations. Banks, in turn, provide loans to businesses and individuals who need them, using those funds, accumulated from deposits. The difference between interest rates on deposits and loans provided by banks is significant, which allows the banks to cover their operational costs, support massive infrastructures, pay lucrative salaries to top managers, and at the same time maintain a sufficient level of bank liquidity.

P2P lending, on the other hand, is by definition a decentralized system, where participants literally lend money to each other. Such systems have the certain benefits of transparency – sometimes knowing directly the parties, lenders provide their money to, they can independently evaluate associated risks, which eventually helps to reduce the time and cost of background checks and other procedures, that otherwise would be needed to be put in place. The absence of expensive intermediaries, in turn, increases the potential profits of lenders and decreases the costs of borrowers, which makes such system more economically efficient. Also, P2P lending has a social element to it similar to that of fundraising; lenders might be personally invested in supporting a certain cause or helping people they sympathize. How will be introducing you to a revolutionary platform FinWhaleX a P2P lending platform that provides access to credit in any place and at any time on the basis of blockchain technologies, machine learning and Big Data.

About FinWhaleX

FinWhaleX - is P2P lending platform that provides access to credit in any place and at any time on the basis of blockchain technologies, machine learning and Big Data.

The world's first P2P credit platform, Zopa, was launched in 2005 in the UK, and since then, P2P platforms have achieved extraordinary growth and have become a vast global industry. This is not surprising, since it is able to provide 2 billions access to credit throughout the world.

However, no region in the world even came close to such an explosive and unprecedented growth in P2P lending, which was noted in the world's second largest economy: China.

In 2007, China first released the P2P platform, and by 2013, that number had soared to 800. By May 2018, 6,142 platforms were operating in China.

In 2016, over 3.4 millions investors were registered on China's P2P platforms, while the increase in the amount of capital involved in P2P lending increased from 21 billions Yuan (3 billions US dollars) in 2012 to 1,411 billions Yuan (216 billions US dollars) in 2016.

Growth of P2P platforms in the West: in 2016 in the UK there were only 9 authorized companies offering crowdfunding platforms based on loans, in the European Union there were 24 platforms with a volume of 3.2 billions Euros, and in the USA - 25 with a volume of 29 billions dollars. According to Dr. Chuanman You, a FinTech expert based at Tel Aviv University, loans emerged in the Oxford Capital Markets Law Journal report on the recent development of FinTech regulation in China.

China’s phenomenal growth in the P2P lending industry is due to both insufficient financing of small and medium-sized enterprises (SMEs) and low-income households by traditional banking institutions, and, on the other hand, high return on P2P investments. According to Dr. You, the lending industry has attracted capital like private and institutional investors.

While financial constraints for SMEs and low-income households are a global problem, the problem is exacerbated by the dominant economic structure of China’s state-owned enterprises combined with repressive financial policies.

In 2016, almost 50% of Chinese P2P platforms were problematic, often fraud, flight of funds, and illegal fundraising were reported. By May 2018, about 2058 platforms encountered liquidity problems or other more serious problems.

China’s initial lack of a comprehensive regulatory regime has contributed to the phenomenal growth of P2P platforms, but it also generated huge market risks that could jeopardize the sustainable development of the industry.

How FinWhaleX Works?

FinWhaleX is a P2P credit lending platform that provides access to loans anywhere and anytime. Let’s take a look at how this works. In order to apply for a loan, the borrower must first set the parameters for the loan. These include the amount, interest rate, loan term, etc. Sometimes the company recommends evaluating the parameters of other applications in order to more easily navigate the process and select the most advantageous offers.

In addition, there are options for choosing an application for a loan on bail. Two ways can be offered for this. First, you can place an application for secured lending. This method is more attractive. Second, you can transfer the required amount of collateral after the lender accepts the application. The commission for filing a loan application is 0.5% of the amount depending on the loan term.

You Place a Loan Application

When creating your loan application, the Borrower set the parameters at its choice (amount, interest rate, period, etc.). We recommend evaluating the parameters of other applications already placed on FinWhaleX - lenders choose the most profitable applications for themselves. You can choose when to secure a loan application with collateral. There are two available ways. On the one hand, you can place the collateralized loan application which is more attractive for creditors. On the other hand, you can transfer the necessary amount of the collateral after the lender accepts your application. When placing the loan application, you need to pay a transaction fee in amount of 0.5% of the loan amount depending on the loan period.

Lender Accepts Your Loan Application

All creditors guarantee to fulfill their obligations for the accepted applications. After the lender accepts the application, FinWhaleX will generate a special multisig-address where your collateral (bitcoins) will be stored until the end of the loan period. Each party owns only one Private key for the multisig-address. Multisignature (multisig) refers to requiring more than one Private key to authorize a Bitcoin transaction. It guarantees that no one is able to access the collateral owning just one Private key.

You Return The Money Within The Term of The Loan

After repayment of the loan, you automatically return the deposit to yourself. No one can use your bitcoins until the loan is repaid - they are frozen in a special wallet. You can not return the loan, if it is not profitable for you. If the rate of bitcoin has not risen or fell, then you can refuse to repay the loan. In this case, the collateral simply goes to the lender, and your loan obligations are repaid.

Token Details

Token name: FinWhaleX

Symbol: FWX

Type: ERC20

Platform: Ethereum

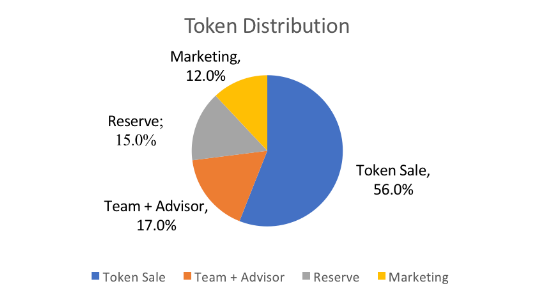

Token Distribution

56% for sales

17% for teams and advisors

15% reserve

12% Marketing and PR

About The FinWhaleX Token

FWX token is a utility token implemented according to the ERC-20 standard on the Ethereum blockchain.

Holders of tokens have access to the platform, increased scoring score for the loan, the possibility of taking a loan and lending to other users.

All transactions within the platform will be conducted only through the FWX token. For example, the issuance of a loan secured token FWX.

The FWX Token will allow its owner to use the FinWhaleX platform to take out a loan and lend to others.

Token provisioning

After the IEO, the token will be available on the main crypto exchanges. The main functionality of the platform will be available only for the FWX token. All transactions of the loan process will be made through the user's wallet on the FWX platform in FWX, thereby ensuring the filling of the purchase glass on third-party exchanges. Further partnerships with exchanges / digital goods platforms will also be made via the FWX token.

Token distribution

Price: 0.00000001BTC

Seed round: 11,700,000,000 FWX

Private round: 45,500,000,000 FWX

Public round: 15,600,000,000 FWX

Token sale: 72,800,000,000 FWX

Team + Advisor: 22,100,000,000 FWX

Reserve: 19,500,000,000 FWX

Marketing:15,600,000,000 FWX

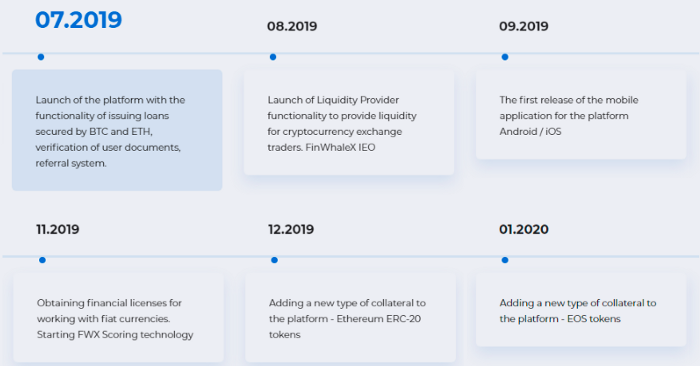

ROADMAP

09.2018

The emergence of an idea about p2p lending based on blockchain technology, smart contracts

11.2018

Market and competitive environment

analysis 01.2019 Concept

development, platform architecture FinWhaleX

03.2019

Platform prototype implementation

04.2019

Private round of financing, demonstration of the platform concept and prototype.

Hiring a development team to implement the product.

05.2019

Presentation of the platform at the conference Russian Tech Week-2019.

Start of development of the platform:

smart contracts / crypto-wallets

web interface / backend.

Mobile application

06.2019

Launch of the beta version of the platform.

07.2019

Launch of the platform with the functionality of issuing loans secured by BTC and ETH, verification of user documents, referral system.

08.2019

Launch of Liquidity Provider functionality to provide liquidity for cryptocurrency exchange traders. IEO FinWhaleX.

09.2019

The first release of the mobile application for the Android / iOS platform.

11.2019

Obtaining financial licenses for working with fiat currencies.

Launch FWX Scoring technology.

12.2019

Adding to the platform of a new type of collateral - tokens Ethereum ERC-20

01.2020

Adding a new type of collateral platform - tokens EOS

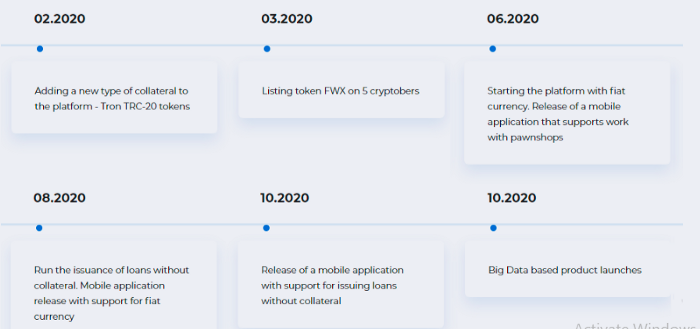

02.2020

Adding a new type of collateral platform - tokens Tron TRC-20

03.2020

Listing token FWX 5 kriptobirzhah

04.2020

Adding to the platform A new type of collateral - digital assets Steam Market (TF2, Dota 2, CS: GO)

05.2020

Getting the platform started to work with pawnshops.

The release of a mobile application with the support of a new type of collateral.

06.2020

Start of operation of the platform with fiat currency.

The release of a mobile application with support for working with pawnshops.

08.2020

Run the issuance of loans without collateral.

Mobile application release with support for fiat currency.

10.2020

Release of a mobile application with support for issuing loans without collateral.

12.2020

Launch of products based on Big Data.

For more information, please visit the links i have provided below;

Website: https://finwhalex.com/

WhitePaper: https://docs.google.com/document/d/1XhjDhhnjHJnTmgHlIzDlwECd4nV5zsPwJEmGZxdqjJ0/edit?usp=sharing

Twitter: https://twitter.com/FinWhaleX/

Facebook: https://www.facebook.com/FinWhaleX/

Instagram: https://www.instagram.com/finwhalex/

Telegram chat: https://t.me/finwhalex

Author: BrainerdPaul

BitcoinTalk profile link: https://bitcointalk.org/index.php?action=profile;u=1680409

Comments

Post a Comment